Diversifying with Bitcoin: High Returns Amid Low Correlation

Investors are looking at Bitcoin as an alternative investment for diversifying their portfolios. Alternative investments often exhibit high volatility and a low correlation to traditional equity and fixed-income markets. Along with Bitcoin’s volatility and low correlation comes outperformance, especially during recent periods. It traded above $90,000 for the first time, with a market cap exceeding $1.7T.

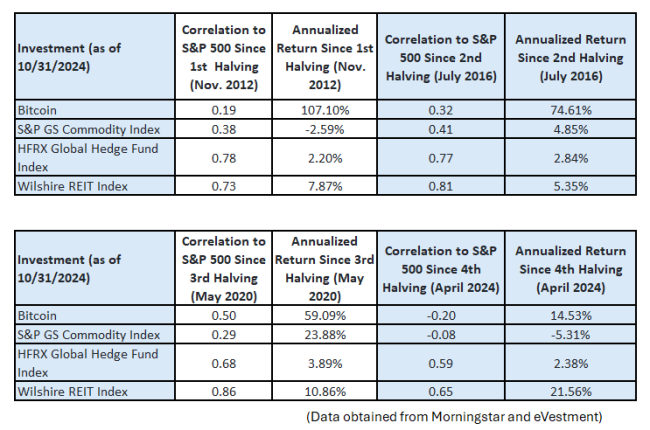

Alternative investments lose some luster if the low correlation to traditional equity markets does not hold. However, looking back, the historical correlation of Bitcoin to the S&P 500 over the last 10 years is 0.34. This is lower than other alternative asset investments over the same period. For example, the HFRX Global Hedge Fund Index has a correlation of 0.78 to the S&P 500 over the last 10 years. More examples of alternative investments and their correlation to stocks are listed below, along with annualized returns over different long-term periods, including critical points in the history of Bitcoin, such as the first two halving events, where the new supply of Bitcoin mined was programmatically cut in half.

As demonstrated above, Bitcoin's long-term historical correlation to the stock market has been very low while boasting better returns than many other investment options. However, its correlation to stocks has been increasing somewhat in recent years. If the period is reduced to the last five years, Bitcoin's correlation to the S&P 500 is increased to 0.53. This is still lower than most of the other alternative investment asset classes listed above, but the trend of increasing correlation over time has been concerning.

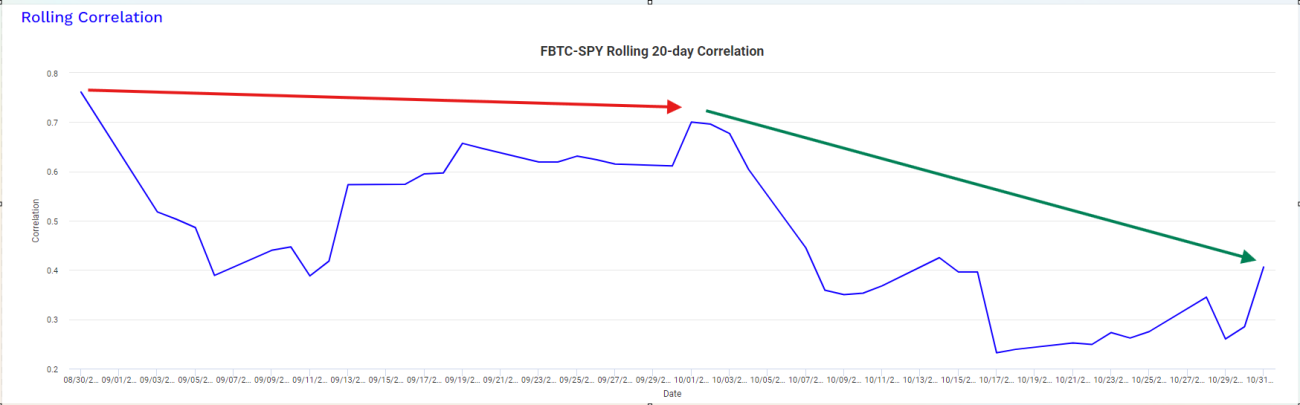

However, over the last few months, the correlation between Bitcoin and the S&P 500 is trending towards its longer-term average. This began in late summer, around the time markets began to price in the likelihood of Donald Trump winning the presidential election, which came to fruition.

The correlation change is represented in the following chart: This chart shows shorter-term rolling daily correlations between the Fidelity Wise Origin Bitcoin Fund (FBTC) and the SPDR S&P 500 ETF (SPY).

Chart Source: Portfolio Visualizer

The red arrow above shows that since the rolling 20-day correlation of daily returns between FBTC and SPY hit its peak, around 0.76, since then, it has been a steady downward trend, especially once October started, which you can see represented by the green arrow above. The correlation dropped below 0.25 before bouncing back slightly towards 0.40. For a while, it seemed that more mainstream attention and widespread adoption of Bitcoin would morph it into another risk-on asset that moved with the equity markets. Still, as we move toward Trump’s inauguration, it has been encouraging to see Bitcoin decouple from the stock market and power ahead to all-time highs in anticipation of favorable regulatory treatment from the new commander-in-chief. Suppose Bitcoin can provide a low correlation to traditional asset classes on top of outsized returns. In that case, it should be able to become a more serious contender for inclusion within institutional investor portfolios.

Contact us to learn about the iSectors® CryptoBlock® Allocation Model. The iSectors® CryptoBlock® Allocation is a uniquely positioned investment model designed to allow advisors and their clients to take advantage of the continuous and rapid adoption of cryptocurrencies and the underlying evolution of the technology that makes them possible: blockchain technology. Cryptocurrencies and investing in blockchain technology can present advisors with distinct compliance and reporting challenges. The iSectors® CryptoBlock® Allocation’s investment strategy aims to simplify the regulatory, transaction, and performance reporting by accessing cryptocurrencies and companies implementing blockchain technology through widely available, liquid, and transparent ETFs.