Dividend Investment Strategies

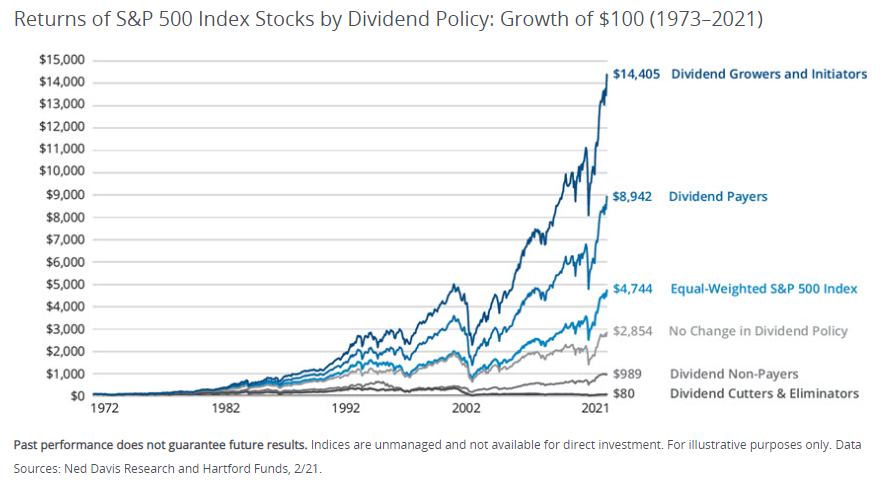

Companies that pay dividends, especially those companies that consistently increase their dividends each year, have historically outperformed the market with less volatility. Because of that, quality dividend paying stocks are a great diversification for any portfolio.

Investing in quality dividend-paying stocks can provide a source of steady income, as well as the potential for long-term capital appreciation. These dividends can serve as a safety net, providing a reliable and predictable stream of income even during market downturns. Companies that consistently pay dividends have a history of stability and profitability, indicating strong financial health and the potential for future growth. Additionally, reinvesting dividends can help compound investment returns over time, providing a path to long-term wealth creation. If you're looking for a smart way to grow your wealth while also enjoying the safety and security of a steady income stream, investing in quality dividend-paying stocks might be a good option for you.

iSectors Domestic Equity Allocation model with its focus on quality dividend-paying* stocks is a way to provide a source of steady income, as well as the potential for long-term capital appreciation.

Disclaimer

*There is no guarantee dividends will be paid. Companies may reduce or eliminate dividends at any time.