ETFs Under the Hood: Value vs. Dividends

Dividend-paying companies are often referred to as value stocks, and this is usually an apt comparison. However, over shorter time horizons, the performance of value ETFs and dividend-focused ETFs can diverge, specifically given the many types of dividend-focused ETFs that exist. For example, there are:

- High dividend ETFs that focus on companies with a high dividend yield, like the SPDR S&P 500 High Dividend ETF (SPYD).

- Backward-looking dividend ETFs, like the ProShares S&P 500 Dividend Aristocrats ETF (NOBL), focus on companies that have increased dividends for 25 consecutive years.

- Forward-looking dividend growth ETFs, like the iShares Dividend Growth ETF (DGRO), attempt to pinpoint dividend-paying companies with the potential to pay increasing dividends in the future.

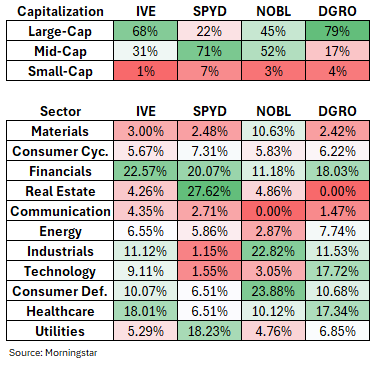

These differ from traditional value ETFs, focusing solely on companies with attractive financial ratios (price to book, price to sales, etc.). One of the more popular ETFs in this space is the iShares S&P 500 Value ETF (IVE). When comparing IVE to the dividend ETFs listed previously, it’s fascinating to see the differences in exposure between the four funds, even though they are all included in Morningstar’s Large Cap Value category, and all include companies from a similar starting investment universe.

The sector exposures and capitalization weights of the four ETFs are listed below:

The first thing that leaps off the page is that IVE and DGRO tilt much heavier towards large caps than SPYD and NOBL. Although SPYD and NOBL could be characterized as mid-cap, Morningstar technically labels all four as large-cap funds. Unsurprisingly, IVE and DGRO have outperformed most other dividend strategies, as large-cap stocks have significantly outperformed small and mid-cap stocks in recent periods powered by the Magnificent 7.

The next item that goes hand in hand with the first observation and another thing that IVE and DGRO have in common is a higher technology allocation. More technology exposure with a tilt towards large caps has been a recipe for success, given the current sentiment in the markets and high levels of liquidity. It will be difficult for either SPYD or NOBL to outperform when technology stocks are in favor because neither of them will likely be able to include these companies for the foreseeable future. The reason is that most technology companies have not been around as long as many other companies in the S&P 500. These companies are focused on growth and do not dedicate capital to paying high dividends. Furthermore, even the technology companies that pay regular dividends have not been around as long and have not paid dividends as long. Hence, this automatically excludes them from an ETF like NOBL, which requires a company to have increased dividends for 25 consecutive years.

The only sectors that all four of these ETFs agree on are small allocations to consumer cyclical, communication services, and energy. Otherwise, the sector exposure is all over the map between the four funds. This variance is another reason to make sure to “look under the hood” of an ETF before you invest or include it in a client portfolio. The sector exposure differences can significantly impact an ETF's performance, as each sector performs differently under various market conditions. It is not as simple as taking the name of an ETF at face value and checking its Morningstar category.