Inflation, Debt, and Interest Rates

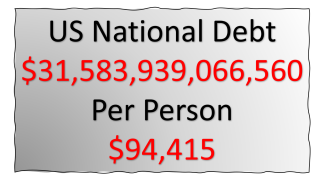

In a recent article by Gerald Dwyer, Professor of Economics at Clemson University, Professor Dwyer, discusses the record-breaking interest payments of US$213 billion made by the US government on its debt in the fourth quarter of 2022, which was an increase of $63 billion from the previous year. The author attributes the increase in interest payments to rising interest rates, which have led to a five-fold increase in borrowing costs over a year. The US government is expected to spend over $1 trillion on interest costs in 2023, which is about 20% of the total federal revenues (tax receipts of 5 trillion). The article also notes that the average maturity of US debt is about 5 years, and as rates stay near 5%, debt servicing costs will continue to rise and compound over time.

The author also points out that the situation is not just limited to the US government, as companies and individuals are also highly indebted, and their interest costs are soaring. The author believes that a Fed pivot will happen soon, even if inflation remains high. Traders are beginning to price a Fed pivot into the market, with traders pricing in a 0.50% (50 basis point) rate cut in the second half of 2023. In such a scenario, inflation continues, and the purchasing power of the dollar deteriorates further. The best forms of money to preserve purchasing power in this environment would be scarce ones like gold, silver, and Bitcoin.