Superior Results with Laddered Bonds Vs Cash

A laddered bond portfolio may be better than cash for several reasons:

- Bonds typically offer higher yields than cash. By laddering a bond portfolio, you can invest in bonds with varying maturities, which can potentially provide a higher overall yield compared to cash.

- Investing in a laddered bond portfolio can provide diversification, as you can invest in bonds from different issuers, sectors, and regions. This can help to reduce the overall risk of the portfolio compared to holding cash.

- Bonds can increase in value if interest rates fall, which can lead to capital appreciation. This potential for capital appreciation can increase the total return of the laddered bond portfolio compared to holding cash.

- Inflation can erode the purchasing power of cash over time. Bonds may offer some protection against inflation by providing a yield that is typically higher than the inflation rate.

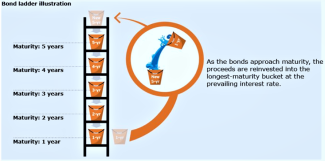

- While cash is highly liquid, a laddered bond portfolio can also provide liquidity. By investing in bonds with different maturities, you can have a portion of your portfolio mature and become available for reinvestment on a regular basis.

Overall, a laddered bond portfolio can offer a potentially higher yield, diversification, potential for capital appreciation, inflation protection, and liquidity compared to holding cash. However, it is important to consider the risks associated with investing in bonds, such as credit risk and interest rate risk, and to consult with a financial professional before making any investment decisions.

iSectors® Domestic Fixed Income Allocation model portfolio simplifies the development and management of a well-diversified laddered bond portfolio. Please visit our website at www.isectors.com or contact us for more information.