Gold Bullion vs Gold Miners: One year later

One year ago, in April 2023, iSectors changed how it accesses the gold market in the iSectors Post-MPT Allocations. We had been using gold mining ETFs as the allocation for the gold asset class. However, the exaggerated volatility and poor performance of gold mining stocks associated with rising inflation and interest rates led us to reconsider the benefits of gold miners compared to gold bullion. Our research led us to decide it was prudent to make a wholesale switch from gold mining ETFs to gold bullion ETFs.

Our decision was not based solely on historical performance data; we also considered other more nuanced factors. The supercharged stimulus during the COVID-19 pandemic ostensibly aided gold miners. However, the rampant inflation that followed the stimulus packages created a challenging environment for gold mining companies. The Federal Reserve’s interest rate hiking cycle that commenced in 2022 only caused more problems for gold miners. Now, not only were these companies dealing with increased costs, but they were also dealing with higher financing expenses. We outlined these problems in detail in our Q1 2023 Performance Overview. Some of the issues pointed out back then are listed below:

- Increasing energy costs: The cost of energy is a major cost for gold mining companies.

- Increasing labor costs: Demand for skilled workers continues to increase.

- Increasing environmental costs: Regulations are becoming more stringent.

- Increasing capital equipment cost: The cost to purchase new or repair existing equipment is rising due to inflation.

- Interest rates: Rising interest rates are making it more expensive for gold mining companies to borrow money as a source of capital, which impacts their ability to invest in new mines, equipment and operations.

We believe these issues remain applicable and will continue to act as headwinds for gold mining companies.

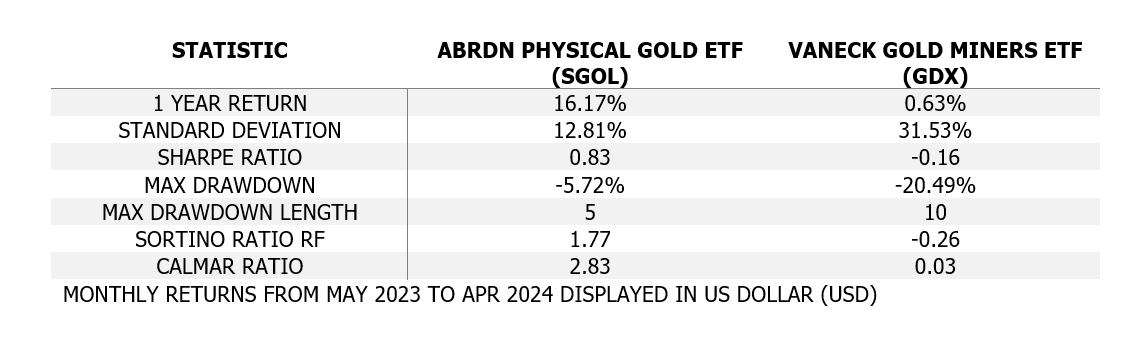

After running the model with gold bullion in place of gold miners for the last year, our decision proved to be the correct one. Miners underperformed bullion, with more volatility and drawdown compared to bullion, as seen in the table below.

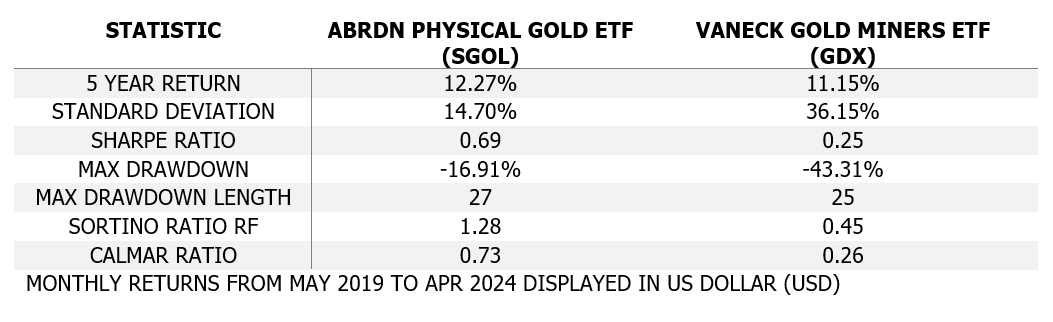

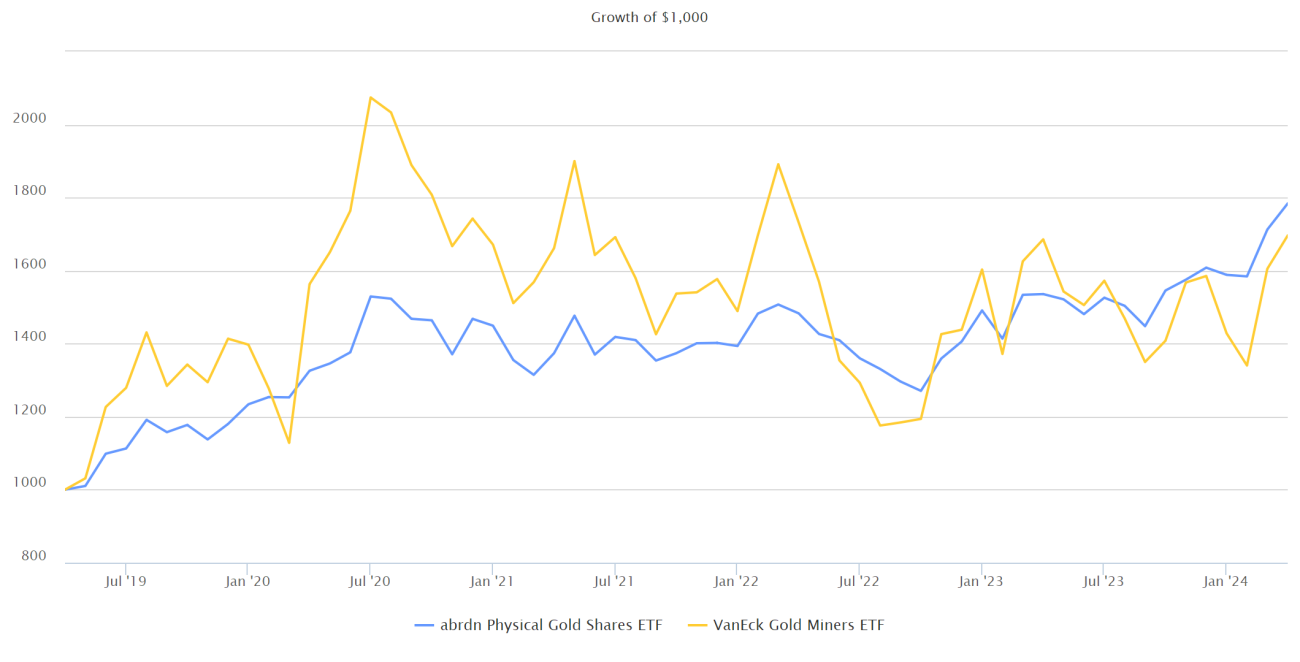

The same sort of volatility difference can also be seen over the last five years. Although the performance between the two has been much closer since 2019, the Sharpe, Sortino, and Calmar Ratios show that SGOL was able to achieve this performance at a much lower volatility level with lower downside than GDX. The Growth of $1,000 chart below the statistics table shows this in a different but illuminating way.

SGOL achieved slightly better results than GDX over the last five years with a much smoother pattern of returns. This volatility profile has been similar in almost every period over the last fifteen years, regardless of whether miners’ raw performance was better than bullion in that period or not.

As we reflect on the decision we made a year ago, we are pleased with the results we have seen so far. However, we remain vigilant and do not assume that this strategy will always be the correct answer. We acknowledge that there will be instances where miners outperform bullion. Yet, we are confident that the exaggerated volatility of miners is a pattern that will persist. We also believe that all the issues that faced the miners a year ago – increasing costs and high interest rates - are still relevant today. Therefore, we maintain our belief that gold bullion will continue to be a better fit within the Post-MPT Allocations for the foreseeable future.

(All data and charts obtained from eVestment and Morningstar)