The correlation between stocks and bonds (as represented by the S&P 500 Index and the Bloomberg US Aggregate Bond Index) has never been higher

Read More

One of the potential ways to protect against the threat of inflation is through Treasury Inflation-Protected Securities (TIPS). Particular slice of the TIPS

Read More

The yield curve is now the most inverted it’s been in over 40 years. That is, short-term interest rates (T-Bills) are higher than long-term interest rates (30

Read More

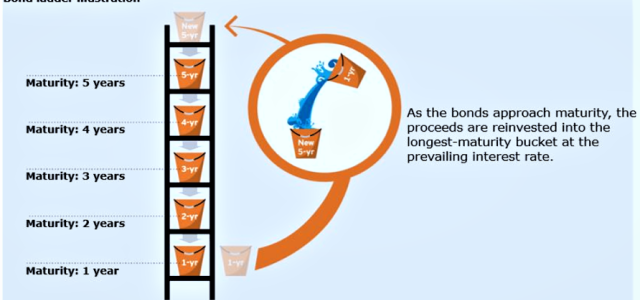

A laddered bond portfolio can offer a potentially higher yield, diversification, potential for capital appreciation, inflation protection, and liquidity

Read More

A wise man once said, “It’s an ill wind that blows no one some good.”

Read More

Ten-year government bond yields have recently tripled from 50 basis points back on August 6, 2020, to about 1.50% today. There is a negative correlation between

Read More